The first two satellites are targeting launch in early 2023 to provide connectivity over North America and the Caribbean, joining four other GEO satellites in the region that have sold all their capacity to Avunu.

However, unlike those satellites, Astranis’ spacecraft use software-defined radios that enable them to be reprogrammed over their seven-to-10 year operational lives as data demands shift in a post-COVID-19 world.

Anuvu also leases capacity from dozens of other GEO satellites worldwide to provide mobility and media services.

Joshua Marks, Anuvu’s CEO, said it is still assessing where the remaining six satellites in its planned constellation with Astranis will target.

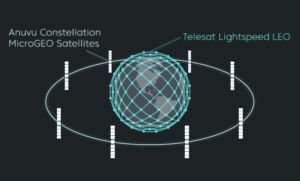

The constellation is part of a multi-orbit strategy that will add capacity from low Earth orbit in 2024 with satellites Canada’s Telesat is developing.

Startup validation

Astranis CEO and co-founder John Gedmark said the Anuvu order validates the startup’s business model for one meter cubed GEO satellites that, under 400 kilograms, can be built in months instead of years.

Traditional GEO communications satellites weigh thousands of kilograms, although they can be more powerful and typically have an operational life of around 15 years.

San Francisco-based Astranis operates the satellites it builds. It provides the capacity through long-term leases that include the ability to reprogram the spacecraft, enabling bandwidth to be moved to where it is needed.

“It’s really important for a mobility application, and in-flight Wi-Fi is no exception, because aircraft and the density of where different aircraft are at different times can shift over time over the course of a day,” Gedmark said.

He added: “[Software-defined satellites have] been a long time coming. I think the industry was stuck in the sort-of analog, bent-pipe mindset for far too long … it’s a great thing for the entire industry and it’s what we need for today’s world, where you have rapidly changing market conditions.”

Astranis is currently building two other satellites, one for an undisclosed customer and another that Gedmark said is in late-stage negotiations.

Arcturus, the first satellite it has sold to a commercial customer, is in the final assembly stage and due to launch early next year for U.S.-based telco Pacific Dataport Inc. (PDI).

Mixing business with leisure

Anuvu crashed into bankruptcy in July 2020 as the pandemic significantly reduced airline and cruise line activities.

The in-flight connectivity industry was under pressure long before COVID-19 travel restrictions came into effect. Analysts widely expect consolidation in an overcrowded market that is navigating through high antenna installation costs.

About half a dozen of Anuvu’s lenders took control of the company to take it out of Chapter 11 protection, shedding about $488 million of its debt in the process.

COVID-19 vaccines have been improving the outlook for mobility markets, although the Delta variant continues to keep certain travel restrictions in place.

The White House, for instance, continues to block non-U.S. citizens arriving from the U.K, European Union, China and other destinations.

Marks said Anuvu already sees strong recovery in aviation, although demand has shifted from business to leisure customers during the pandemic.

However, he said the demand from leisure customers is becoming increasingly demanding and dynamic.

“As we look at aviation, now with the recovery from COVID underway, we’re seeing new pressure from passengers wanting very fast, very responsive connectivity wherever they are,” Marks said.

Using software-defined satellites, he said Anuvu can optimize services depending on an aircraft’s needs, from focusing on download capabilities for streaming media to upload capacity for passengers increasingly looking to work remotely.

“If you can get focused on what the end-user requirements are in mobility, you can optimize the passenger experience for those on board,” he said.

“We think that provides the best mix for passengers as we recover from COVID, but we certainly are seeing that recovery in traffic today, and we’re seeing it across the different mobility markets we serve.”

Anuvu sees Astranis satellites as a foundational layer for a more flexible and adaptable mobility business, but plans to continue augmenting it by leasing capacity from larger, higher throughput GEO satellites “on the traditional model,” as well as LEO spacecraft as they become available.

Large GEO satellites will later take a backseat as LEO satellites become the primary source of connectivity, supported by smaller GEO spacecraft with targeted beams.

“We see micro GEO as both a technological and an agility innovation,” Marks said.

“It allows us to launch capacity faster, and to put that capacity specifically where we need it, when we need it.”