People began showing up unsolicited, asking to buy spacecraft because Astro Digital could quickly configure buses to meet their needs.

Once Astro Digital gained a reputation for speeding up satellite integration, the company began offering a suite of services in 2018 to address the technical, financial and regulatory challenges associated with spaceflight.

Chris Biddy, Astro Digital CEO and co-founder, said the service approach has helped the business grow and led to work on “incredibly innovative missions.”

At the time, Astro Digital’s pivot to a service model was unusual. Even though space-based communications, engineering, launch and some imagery was sold through service contracts, the space business largely revolved around product sales.

Not anymore. As the space sector expands, companies large and small are adopting new business models, including Space Data as a Service, Satellite as a Service and Ground Station as a Service, which promise the benefits of space without the demands of satellite manufacturing, government regulations, launch integration or space data delivery.

“This is what I believe will continue to drive the explosive growth of companies and funding,” said Peter Platzer, CEO and co-founder of San Francisco-based Spire Global. “I don’t think the biggest use cases of collecting data or doing something from space have yet been invented. We are bringing down the barriers to starting something the same way cloud services brought down the barriers to starting a software or e-commerce company.”

SOFTWARE AS A SERVICE

The computer sector went through a similar transformation a couple of decades ago when it began to offer Software as a Service, meaning people could access software through subscriptions from companies that hosted it online rather than installing it on their own computers.

Software companies “put the service team around the software, so the customer could use it on day one,” said Dan Ceperley, LeoLabs CEO and co-founder. “That’s a big part of this current revolution: this platform mentality has hit the space industry.”

LeoLabs of Menlo Park, California, created an analytics platform that ingests data from the company’s global network of phased array radars tracking objects in low Earth orbit. Through the LeoLabs Platform, customers can search for satellites, see traffic patterns and receive warning when spacecraft are at risk of colliding.

Software as a Service was first made possible by massive server networks and later extended by cloud infrastructure. Falling satellite and launch prices, the proliferation of ground stations and, in LeoLabs’ case, satellite-tracking radars cleared the way for Space as a Service.

An important benefit of the service model for space companies is scale.

It’s expensive and time-consuming to purchase a single satellite and establish the ground segment and operations staff to gather data or relay communications.

“Your entry cost is dominated by the fact that you have to do everything from the ground up,” said Walter Scott, Maxar executive vice president and chief technology officer. “There are opportunities instead to spread that infrastructure cost across a large customer base.”

In addition, subscription service providers reap the rewards of a large customer base.

“We can sell imagery and data feeds multiple times to multiple clients,” said Will Marshall, Planet CEO and co-founder. “The incremental cost to sell a data feed to a second user is almost nothing.”

Venture capitalists are well aware of the benefits, having profited in many cases from investing in Software as a Service.

“Look at how successful it’s been in Silicon Valley where all these services have generated trillions of dollars of wealth,” Ceperley said. “We’re seeing that come flooding into the space industry. It’s only going to continue to accelerate the changes.”

SPACE DATA AS A SERVICE

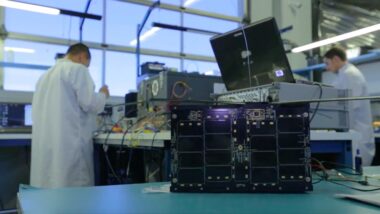

In contrast to LeoLabs, which was founded to provide Space Situational Awareness services, AAC Clyde Space is expanding to offer services. The satellite manufacturer and component supplier, formed in 2018 when Sweden’s AAC Microtec acquired Clyde Space of Scotland, announced two acquisitions in October 2020 as part of its SpaceData-as-a-Service strategy.

AAC Clyde purchased Hyperion Technologies of the Netherlands to gain manufacturing capacity and expertise in key subsystems and SpaceQuest Ltd., a Fairfax, Virginia, satellite technology firm with a constellation of operational satellites and ground stations.

Before the acquisitions, AAC Clyde was preparing to collect and deliver maritime-tracking data through cubesats for Orbcomm, a company based in Rochelle Park, New Jersey, known for linking assets in the Internet of Things.

“Orbcomm doesn’t have to worry about the space segment or the ground stations because we do all that and deliver the data,” said AAC Clyde Space CEO Luis Gomes. “We are seeing more and more of that from customers that always wanted access to images or weather data but never thought they could get them because they would need satellites.”

Even defense and intelligence agencies with their own satellite fleets are turning to commercial data services to shift the cost of research and development to the private sector. It shifts risk, too.

“If a company builds a synthetic aperture radar satellite that doesn’t succeed, the government doesn’t have to buy the services,” said Chris DeMay, founder and chief operations officer for Trustpoint, a Mountain View, California, startup focused on resilient GPS, and former HawkEye 360 founder and chief technology officer. “There are genuine cost and schedule benefits as well. The U.S. government is not in a position to operate at the fast pace of innovation of a Silicon Valley startup.”

By taking advantage of commercial services, military services also lower personnel costs. “This is an especially helpful way to address some of the retention issues around technology and data analyst positions,” said Lindsey Polley, Starburst Aerospace defense accounts director. “Of course, we will always need these individuals in the military to work on classified assignments, but contracting-out unclassified work can be significantly cheaper when you think about the costs associated with training a soldier or guardian to perform some of the more advanced analytics jobs.”

SATELLITE AS A SERVICE

Organizations new to the space sector and veterans alike are finding shortcuts to orbit through Satellite as a Service. In this increasingly popular business model, anyone seeking to test a satellite sensor, radiation-tolerant circuit board or spaceflight software can hand it off to various companies including ISISpace of the Netherlands, San Francisco-based Loft Orbital, NanoAvionics of Lithuania, Spire Global or Denver-based York Space Systems.

Spire Space Services customers specify the amount of data storage, processing and power their payload needs and Spire handles the rest. Whether it flies alongside weather, maritime and aircraft-tracking sensors on a cubesat in Spire’s Lemur constellation or on another Spire cubesat “is completely irrelevant,” Platzer said, comparing it to cloud services. As long as customers get the services they signed up for, they don’t care if books are being sold or movies are streaming from the same server.

CesiumAstro, a startup based in Austin, Texas, that sells active phased array antennas and software-defined payloads, also is responding to demand for spaceflight services.

“Not all customers have the ability to buy a payload, buy a satellite, integrate the whole thing, plan a mission, launch it into orbit and acquire the satellite data,” said Shey Sabripour, Cesium founder and CEO. “We have some customers that are essentially renting time on our satellite to run experiments.”

Even customers with vast space expertise note the benefits.

NASA certainly could build a satellite for its air pollution sensor built by Ball Aerospace, Tropospheric Emissions: Monitoring of Pollution (TEMPO). Instead, the space agency handed off TEMPO to Maxar for integration and launch on a commercial communications satellite. Hosted payloads follow the Satellite-as-a-Service model.

Launching a sensor on a commercial communications satellite saves money “because you’re not having to start from ground zero,” Scott said. “You’re able to build on something that already exists.”

GROUND AS A SERVICE

The same economies of scale that benefits satellite customers are evident in the ground segment.

“We offer a much more affordable price because we operate 100,000 satellite passes a month,” said Katherine Monson, CEO of KSAT Inc., the U.S. arm of Kongsberg Satellite Services of Norway. “Companies with a smaller volume have to divide their fixed costs fewer ways.”

AWS Ground Station and Microsoft’s Azure Orbital advertise their ability to handle satellite command and control as well as data downlink through Ground Station as a Service.

Satellite operators who request time on an Azure Orbital antenna, for instance, send data directly to the Azure cloud.

“You can use our fiber network to move data around the planet at a fraction of what it might cost if you were to do it yourself as a space provider,” said Tom Keane, Microsoft Azure Global corporate vice president. “When you combine the technology that existing players have with the technology that we have as a cloud provider, you can do some pretty amazing things.”

Cloud services have helped reduce the cost of establishing a space company because startups don’t have to build their own data processing and storage infrastructure.

Planet considered creating cloud computing systems for the “gobs of data” it planned to produce before the cost of commercial cloud services dropped, Marshall said.

In spite of the surging popularity of cloud and other space-related services, sales of satellites and other space products are expected to remain strong.

“There will always be a combination of products and services like in the tech world, where people who rely on cloud services still buy their own computers,” said Chuck Beames, York Space Systems executive chairman and SmallSat Alliance chairman.

This article originally appeared in the June 2021 issue of SpaceNews magazine.