Although the issue mostly affects very high volume production businesses, such as those in the automotive and consumer electronics industries, it has sent ripples through the space industry.

“Any component shortage can have a direct impact on timely deliveries and this is obviously a concern for us at Airbus,” Andreas Lindenthal, head of business operations for Airbus Space Systems, told SpaceNews.

“We are aware of current shortages on components and are working with our supply chain to mitigate the impact.”

Airbus has a joint venture with low Earth orbit broadband operator OneWeb called OneWeb Satellites, which aims to churn out more than one satellite a day for the expanding megaconstellation.

Startup challenges

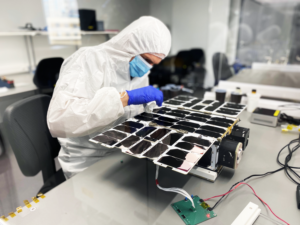

Access to semiconductors has been a challenge for smaller space companies long before the pandemic, according to nanosatellite maker NanoAvionics CEO Vytenis Buzas.

These companies must compete with bigger buyers of semiconductors in other industries “with an immense product output” that gives them priority, Buzas said.

However, he added Lithuania-based NanoAvionics “hasn’t drastically felt any supply shortage yet and we haven’t had any delays in our lead times or production of satellite buses.”

Part of the reason is that it started stocking up on supplies at the start of 2020, before the pandemic tightened its grip on supply chains.

“Those stocked components will last us about two years,” Buzas told SpaceNews.

“What we have seen though is that today these same components have lead times of one year or longer.”

The company is also partly shielded from external manufacturing disruption because it builds about 95% of its satellite subsystems in-house, with a controlled stock of components and raw materials.

Buying local

Large aerospace and defense companies that produce satellites also tend to have dedicated foundries for producing semiconductors.

Boeing, Lockheed Martin and others with satellite businesses have benefited from being classed as essential by the U.S. government during the pandemic.

That has helped them accelerate payments to keep the small and vulnerable suppliers they do use healthy — sometimes even speeding up deliveries of materials.

Amid trade tensions with China, U.S. federal policy is also seeking to incentivize domestic semiconductor infrastructure to increase supplies.

The Biden-Harris administration recommended Congress support at least $50 billion in investments to advance domestic semiconductor manufacturing, and promote research and development, as part of a 100-day supply chain review published June 8.

Future outlook

Satellite makers at the smaller end of the market can benefit from forming stronger relations with suppliers, Buzas added, treating them as extensions of their team.

“We also expect to better manage costs and supply with the growth of satellite production,” he said.

“Downstream companies are starting to build their constellations, which after initial pathfinder missions will eventually happen very quickly.

“Lots of microchip factories had to freeze operations during the first wave of the pandemic. Now they really need to catch up with their backlog and new orders due to growing demand for electronic products. At NanoAvionics, we believe that this is only a temporary problem because ramping production up is a better problem to deal with than having no demand.”

While it is difficult to estimate the pandemic’s impact on future supply chains, and the different speed of recovery across international markets, Buzas expects an “at least temporary increase of prices in some certain areas.”