The selection of European manufacturer Thales Alenia caps a yearslong evaluation of competing providers. Thales Alenia Space in 2018 teamed with Maxar Technologies in a joint bid to take on Airbus Defense and Space. Thales Alenia and Maxar later split up and the Telesat constellation became a three-way competition.

Dan Goldberg, president and CEO of Telesat, told SpaceNews that Thales Alenia Space was selected for its satellite design but also for its engineering and ground services. The $3 billion deal is for the production of 298 satellites, network management software and for the integration of the satellites with gateways to be deployed around the world. The entire investment projected for Lightspeed is $5 billion.

Goldberg said Telesat and Thales Alenia have been working on the bus design for more than two years. He said Telesat was impressed by Thales Alenia’s performance as the prime contractor of the Iridium NEXT constellation and by the satellites it produced for SES’ O3B network. “That was a big part of our decision to select them,” he said.

Details about where the satellites will be manufactured have yet to be announced. “We expect that soon,” said Goldberg. “There will be significant job creation in Canada and in Europe.” Launches will start in 2022. The plan is to produce a satellite a day.

Telesat in 2019 signed an agreement with Jeff Bezos’ Blue Origin for launch services on the New Glenn rocket but it’s not exclusive, said Goldberg. “We’ll be working with other launch providers too.”

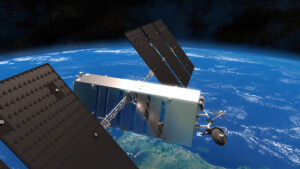

Telesat’s 700-kilogram satellites will be launched to polar and inclined orbits — 78 satellites will deploy to a polar orbit with 13 satellites in six planes at an altitude of 1,015 kilometers. The other 220 will go to an inclined orbit with 11 satellites in 20 planes at an altitude of 1,325 kilometers. The architecture was designed for pole-to-pole global coverage, concentrating capacity in some areas where more demand is expected, the company said.

Goldberg said Telesat’s target markets are network operators, internet service providers, the maritime industry and governments. He insisted that Telesat does not view SpaceX’s massive internet constellation Starlink as a direct competitor. “Our focus is very different,” he said. “We’re a business to business provider, consumer broadband is not our focus.”

Telesat said it is developing several types of user terminals for different markets.

Each Telesat satellite will have four laser communications terminals for inter-satellite and space-to-ground connectivity. That will allow Telesat to offer capacity on its network for customers to move data, including the U.S. government.

“With optical inter-satellite links we can route traffic all over the world,” said Goldberg. “This minimizes the number of gateways we need.”

Having high-bandwidth data links creates a market opportunity, Goldberg said. Companies or government organizations that operate their own spacecraft and have compatible optical links can hop onto Telesat’s network “and we can move traffic for them,” he said.

This capability is of interest to the U.S. Defense Advanced Research Projects Agency and the Space Development Agency which are building mesh networks in low-Earth orbit. Telesat was selected by DARPA’s Blackjack program to demonstrate optical inter-satellite link technology in orbit. The company also teamed with Lockheed Martin to study the interoperability between Telesat’s LEO constellation and satellites Lockheed Martin is building for the Space Development Agency.

“That is certainly a big part of the work we’ve been doing with DARPA to demonstrate how the U.S. government could have their own satellites that could leverage the global optical network,” said Goldberg. “This would give them a more flexible and cheaper option to deploy capabilities.”